How To Conversion Factor

The market status window is an indication regarding the current technical availability of the trading system. It indicates whether news board messages regarding current technical issues of the trading system have been published or will be published shortly.

Reference dates for which conversion factor is computed (usually the first day of delivery months), specified as an N-by-1 vector of serial date numbers.

Data Types: double

Maturity date, specified as a N-by-1 vector of serial date numbers.

Data Types: double

CouponRate — Annual coupon rates for underlying bond

vector in decimals

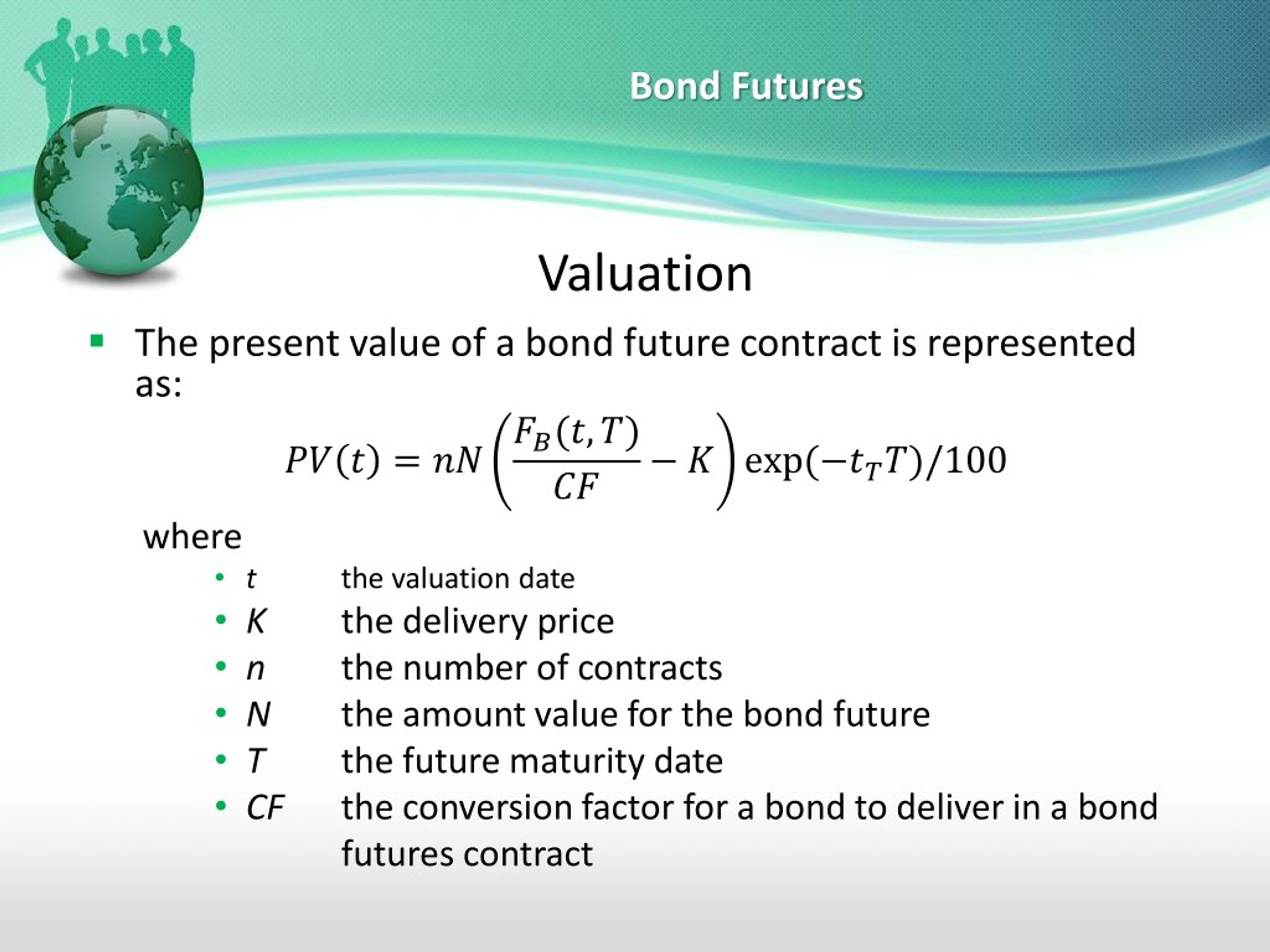

- If the seller delivers a given bond, he receives the futures price, times the conversion factor, plus accrued interest. The seller’s net cash flow from delivering is G x CF(i) – Price of Bond i Cheapest-to-Deliver with No Conversion Factors: Suppose all bonds have a 6% coupon All bonds with a 6% coupon have conversion factor equal to 1.

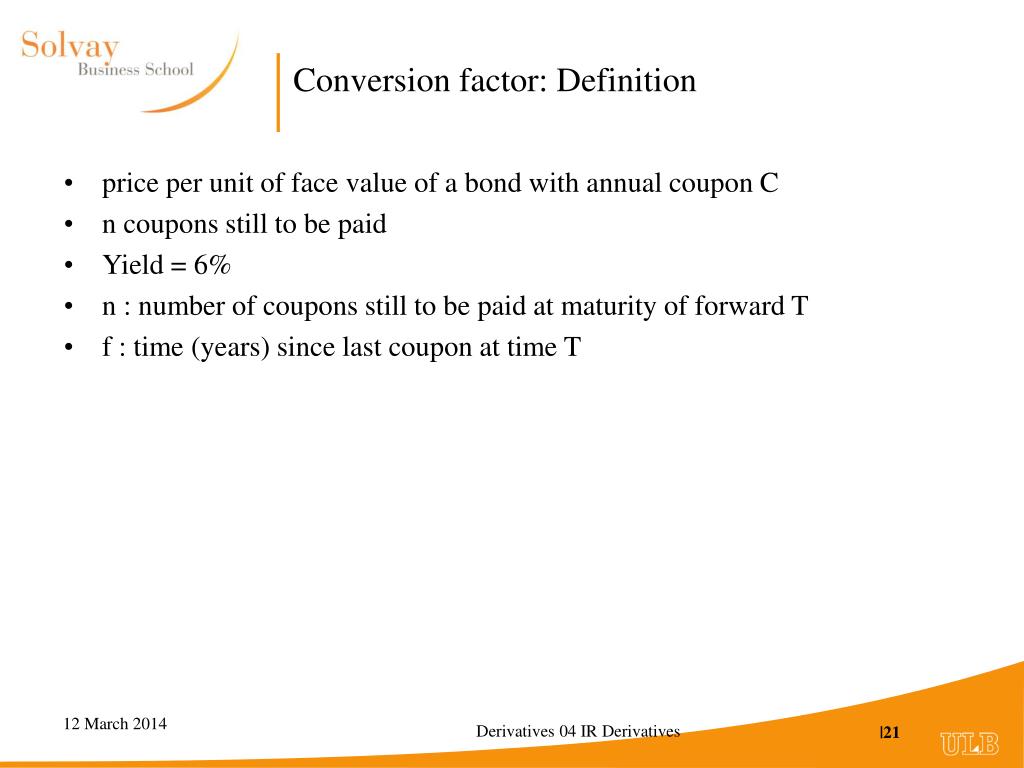

- Conversion factors of US Treasury bonds and other government bonds are based on a bond yielding 6%. Optionally, you can specify other types of bonds and yields using inputs for RefYield and Convention. For US Treasury bonds, verify.

Annual coupon rates for underlying bond, specified as an numBonds-by-1 vector in decimals.

Data Types: double

Name-Value Pair Arguments

Specify optional comma-separated pairs of Name,Value arguments. Name is the argument name and Value is the corresponding value. Name must appear inside quotes. You can specify several name and value pair arguments in any order as Name1,Value1,...,NameN,ValueN.

CF = convfactor(RefDate,Maturity,CouponRate,'Convention',2)'Convention' — Conversion factor convention

1 US Treasury bond (30-year) and Treasury note (10-year) futures contract (default) | integer from 1 to 5

Conversion factor convention, specified as the comma-separated pair consisting of 'Convention' and a N-by-1 vector using the following values:

1= US Treasury bond (30-year) and Treasury note (10-year) futures contract2= US 2-year and 5-year Treasury note futures contract3= German Bobl, Bund, Buxl, and Schatz4= UK gilts5= Japanese Government Bonds (JGBs)

Data Types: double

'FirstCouponDate' — Irregular first coupon date

serial date number

Irregular first coupon date, specified as the comma-separated pair consisting of 'FirstCouponDate' and a N-by-1 vector using a serial date numbers.

Data Types: double

'RefYield' — Reference semiannual yield

0.06 (6%) (default) | vector in decimals

Reference semiannual yield, specified as the comma-separated pair consisting of 'RefYield' and an N-by-1 vector in decimals.

Data Types: double

Conversion Factor Definition

'StartDate' — Forward starting date of payments

serial date number

Forward starting date of payments, specified as the comma-separated pair consisting of 'StartDate' and a N-by-1 vector using serial date numbers.

Conversion Factor Bond

Data Types: double

- By CME Group

- January 06, 2021

- Read about SOFR-based fallbacks for Eurodollars, accelerated adoption of CME SOFR products at the end of 2020, and more.

- By CME Group

- December 28, 2020

- Read about different uses for One-Month SOFR options, including hedging pricing risk, trading volatility on short-end, spreads with Fed Funds, and mor...

- By CME Group

- December 17, 2020

- With mounting focus on margin and capital costs, CME Group recently added Eurodollar options into IRS Portfolio Margining alongside CME Interest Rate ...

- By Jonathan Kronstein

- December 08, 2020

- With Treasury increasingly committed to the 3-year tenor, learn how to analyze the market complexities with CME TreasuryWatch and other QuikStrike too...